An Unbiased View of Paul B Insurance

Wiki Article

5 Simple Techniques For Paul B Insurance

stands for the terms under which the insurance claim will certainly be paid. With residence insurance policy, as an example, you could have a replacement expense or actual cash worth policy. The basis of just how insurance claims are worked out makes a large influence on just how much you make money. You must always ask exactly how cases are paid as well as what the cases process will certainly be.

They will record your insurance claim and also look into it to locate out what happened and also how you are covered. Once they choose you have a protected loss, they might send out a look for your loss to you or perhaps to the service center if you had an auto accident. The check will be for your loss, minus your deductible.

The thought is that the cash paid out in cases over time will be much less than the total costs collected. You might really feel like you're tossing cash out the home window if you never sue, yet having item of mind that you're covered on the occasion that you do endure a considerable loss, can be worth its weight in gold.

The Definitive Guide for Paul B Insurance

Envision you pay $500 a year to guarantee your $200,000 residence. This means you have actually paid $5,000 for house insurance policy.

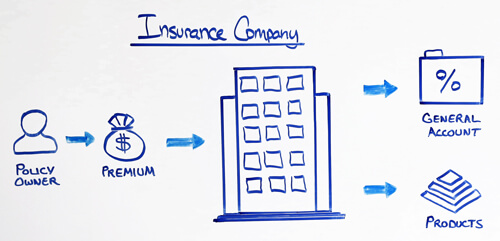

Because insurance coverage is based on spreading out the danger among many individuals, it is the pooled cash of all people paying for it that permits the business to build assets and also cover cases when they occur. Insurance is a business. It would be good for the business to simply leave prices at the very same degree all the time, the reality is that they have to make adequate cash to cover all the prospective insurance claims their insurance policy holders might make.

Underwriting adjustments and price increases or reductions are based on outcomes the insurance coverage firm had in past years. They offer insurance policy from only one firm.

The smart Trick of Paul B Insurance That Nobody is Discussing

The frontline individuals you take care of when you buy your insurance coverage are the representatives and brokers who represent the insurance here coverage firm. They will certainly explain the type of Get More Info products they have. The captive agent is an agent of just one insurance policy business. They a knowledgeable about that firm's items or offerings, yet can not talk towards other business' policies, prices, or product offerings.

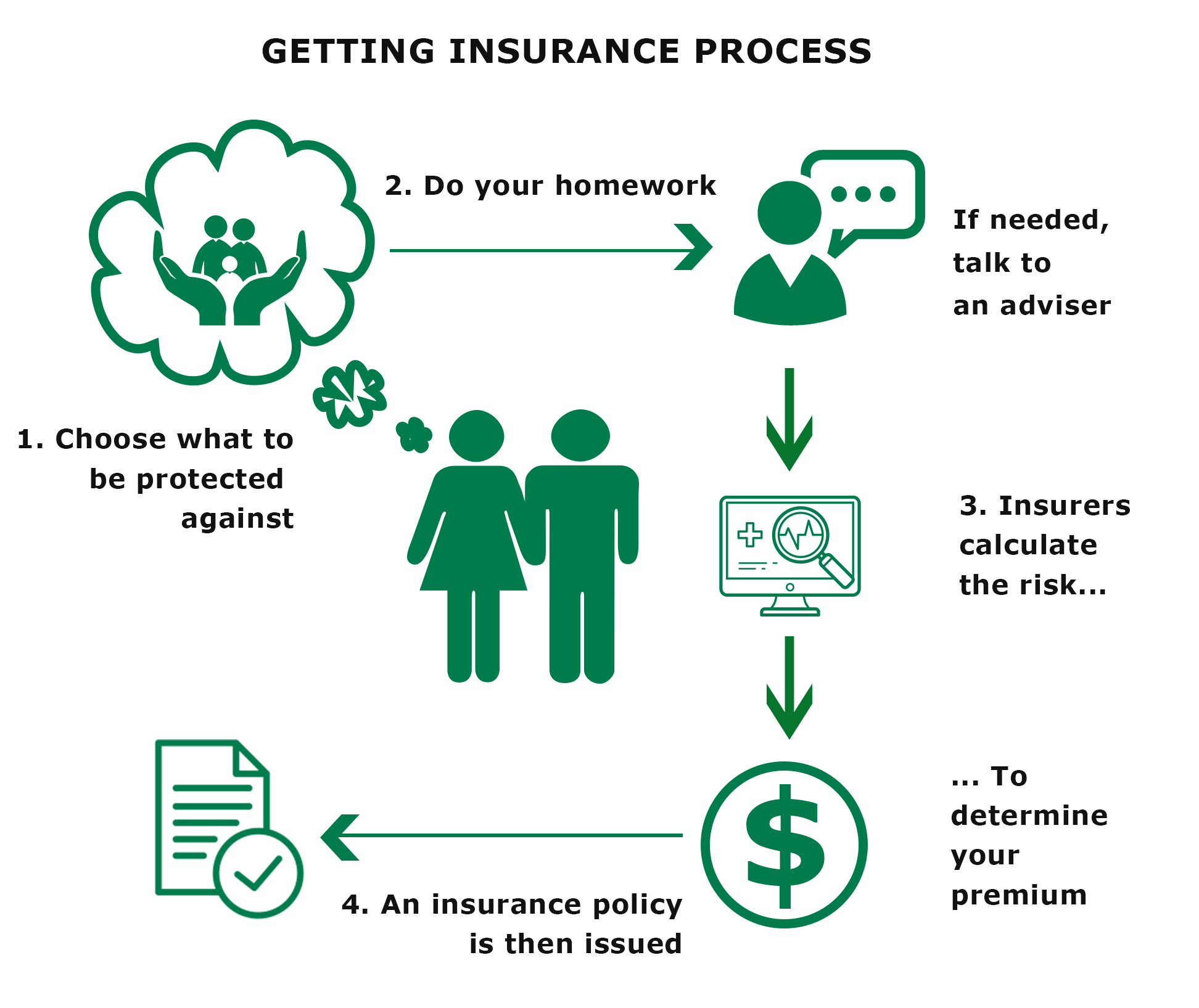

Just how much risk or loss of money can you think on your very own? Do you have the cash to cover your costs or debts if you have an accident? Do you have special requirements in your life that call for added coverage?

The insurance coverage you require differs based upon where you are at in your life, what type of assets you have, as well as what your long-term objectives and tasks are. That's why it is important to put in the time to review what you want out of your plan with your agent.

10 Easy Facts About Paul B Insurance Explained

Visit WebsiteIf you secure a finance to buy a vehicle, and afterwards something happens to the vehicle, void insurance will certainly repay any part of your lending that typical automobile insurance coverage does not cover. Some loan providers require their customers to carry void insurance coverage.

The main objective of life insurance policy is to offer cash for your beneficiaries when you die. How you die can determine whether the insurer pays out the fatality advantage. Relying on the sort of plan you have, life insurance can cover: Natural deaths. Dying from a cardiac arrest, illness or seniority are instances of natural deaths.

Life insurance coverage covers the life of the insured individual. Term life insurance coverage covers you for a duration of time selected at purchase, such as 10, 20 or 30 years.

The Best Strategy To Use For Paul B Insurance

If you don't die throughout that time, no one makes money. Term life is preferred because it uses huge payments at a lower price than long-term life. It additionally provides protection for an established variety of years. There are some variations of typical term life insurance policy policies. Convertible policies enable you to transform them to permanent life plans at a greater premium, enabling longer and also possibly much more versatile insurance coverage.

Irreversible life insurance policy policies construct cash money worth as they age. The money value of whole life insurance policy plans grows at a fixed price, while the cash money worth within universal policies can vary.

$500,000 of entire life protection for a healthy and balanced 30-year-old woman prices around $4,015 every year, on standard. That exact same level of insurance coverage with a 20-year term life policy would certainly set you back a standard of about $188 each year, according to Quotacy, a brokerage company.

What Does Paul B Insurance Mean?

Variable life is one more irreversible life insurance choice. It's an alternate to entire life with a set payment.

Below are some life insurance coverage essentials to help you better understand just how coverage works. Costs are the payments you make to the insurance provider. For term life policies, these cover the price of your insurance as well as management prices. With a permanent policy, you'll additionally be able to pay money right into a cash-value account.

Report this wiki page